First Time Abatement

By Greg Daer

February 19, 2025

If you’ve ever been late paying or filing a tax return, it can feel like a big punch in the gut to realize that you’ve had penalties assessed to your IRS account.

There’s some good news: if this was a “one off” type of situation, you might qualify for something called ‘First Time Abatement’ (FTA). Not all penalties qualify, but the types that may qualify are: Failure to File, Failure to Pay, and Failure to Deposit penalties. A tax professional can also look into this for you. If you haven’t didn’t file or pay on time on your 2023 tax return filed last year, you wouldn’t qualify for FTA for 2024, assuming it isn’t filed/paid on time, but you may still qualify for FTA for the 2023 tax year.

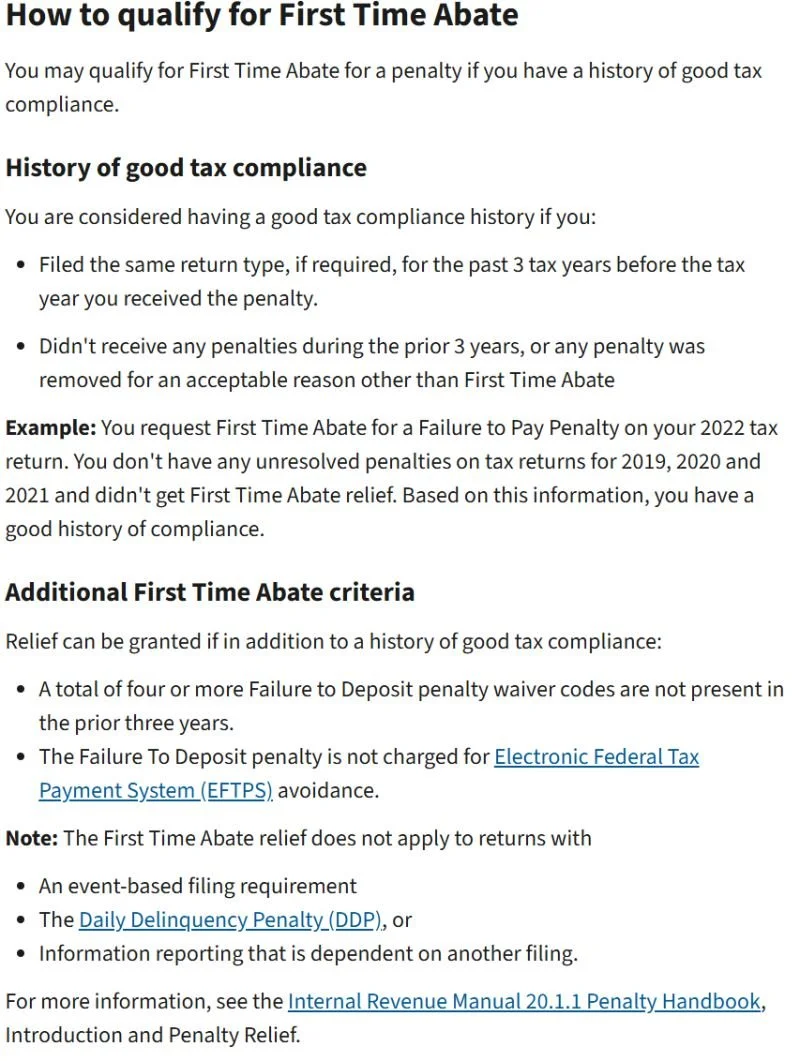

Unfortunately, the quickest way to request FTA is a phone call to the IRS. The screenshot on the right has information and criteria about FTA from IRS.gov.